Wake County Property Tax Rate 2024 Guide Printable

Wake County Property Tax Rate 2024 Guide Printable – Erin Davis/Axios VisualsWake County property owners have been getting their new tax appraisals in the mail this past week, and the numbers show an area absolutely soaring in value coming out of the . If you’ve got sticker shock after seeing your new Wake County property tax values, there are ways you can challenge the figures. Residential properties rose an average of 53% in tax value from the .

Wake County Property Tax Rate 2024 Guide Printable

Source : www.wake.gov

2022 Endorsements: Wake County INDY Week

Source : indyweek.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Holly Rucker, Caul Group Residential, Brokered by EXP Realty | Cary NC

Source : m.facebook.com

December 2023’s Median Price of Wake County Real Estate increased

Source : www.wake.gov

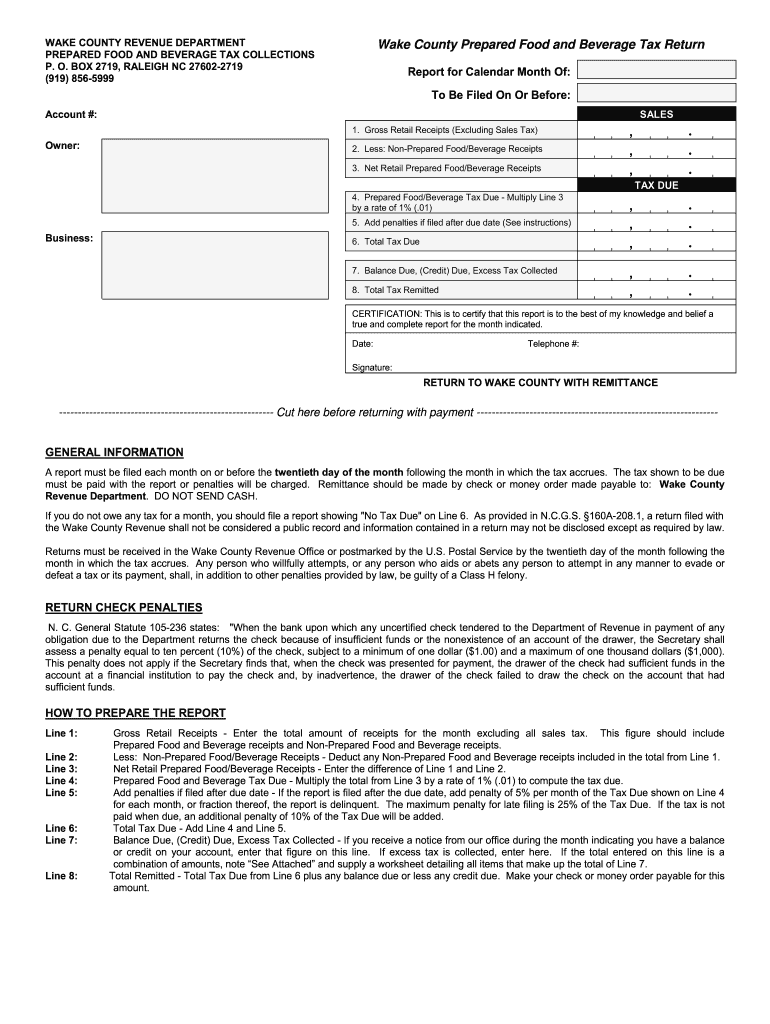

Wake county food and beverage tax: Fill out & sign online | DocHub

Source : www.dochub.com

December 2023’s Median Price of Wake County Real Estate increased

Source : www.wake.gov

2024 Official Charleston Area Destination Planning Guide by

Source : issuu.com

July 2023’s Median Price of Wake County Real Estate decreases by

Source : www.wake.gov

RecConnect | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Wake County Property Tax Rate 2024 Guide Printable Tax Administration updates leaders on Wake County property : While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral .